Guide to House Records: Chapter 21

Records of the Ways and Means Committee

Committee records described in this chapter:

- Committee on Ways and Means (1795-1865)

- Committee on Ways and Means (1865-1946)

- Committee on Ways and Means (1946-1968)

- Committee on Ways and Means (1969-1986)

History and Jurisdiction

21.1 The Committee on Ways and Means is the oldest standing committee in Congress. The idea of a "committee on ways and means" to handle the financial matters of a legislature is older than the Federal Congress, having been used in the English Parliament and the colonial and State legislatures in America. Early in the first Congress a select committee on ways and means was formed, but subsequently was disbanded when Alexander Hamilton was appointed Secretary of the Treasury and the House chose to let him handle a large part of the financial matters of the new nation. In 1795 another Select Committee on Ways and Means was formed, and was regularly reappointed in each session until it was defined as a standing committee in 1802. Since that time the committee has functioned as one of the most powerful in the House.

21.2 During its long history the jurisdiction and duties of the committee have changed significantly. The original jurisdiction of the standing committee in 1802 was defined as follows:

- It shall be the duty of the said Committee of Ways and Means to take into consideration all such reports of the Treasury Department, and all such propositions relative to the revenue, as may be referred to them by the House; to inquire into the state of the public debt, of the revenue, and of the expenditures, and to report, from time to time, their opinion thereon; to examine into the state of the several public departments, and particularly into the laws making appropriations of moneys, and to report whether the moneys have been disbursed conformably with such laws; and, also, to report, from time to time, such provisions and arrangements, as may be necessary to add to the economy of the departments, and the accountability of their officers.1

21.3 In 1814, in order to relieve the committee of some of its duties, the jurisdiction concerning the state of the several public Departments, the laws making appropriations of money to them, and reports on whether the money was disbursed according to the laws, was given to a newly created Committee on Public Expenditures.

21.4 The Committee on Ways and Means has reported most major revenue bills since 1794 with the exception of a period between 1819 and 1833 when the Committee on Manufactures reported a number of protectionist tariff bills including the "Tariff of Abominations" of 1828.

21.5 Until 1865 the committee reported the overwhelming majority of all regular appropriations bills, the three main exceptions being general public works, lighthouses and associated expenses, and rivers and harbors bills that were reported by the Commerce Committee. As the business of the Government grew, the number of appropriations bills grew, as did the revenue work of the committee. In 1865, primarily as a result of overwork due to the financial demands of the Civil War, the jurisdiction of the committee was narrowed by giving portions of it to two new committees: Banking and Currency, and Appropriations.

21.6 In proposing the 1865 rule that would divide the jurisdiction of the Ways and Means, Samuel S. Cox, a member of the Select Committee on Rules observed:

- It is utterly impossible in the present condition of our finances that one committee can do all this labor... powerful as the committee is constituted, even their powers of endurance, physical and mental, are not adequate to the great duty which has been imposed by the emergencies of this historic time. We divide the Ways and Means into three committees. The Ways and Means are still preserved, and their future duty is to provide "ways and means," that is, raise revenue for carrying on the Government. This includes of course, the tariff, the internal revenue, the loan bills, legal-tender notes, and all other matters connected with supporting the credit and raising money... The proposed Committee on Appropriations have, under this amendment, the examination of the estimates of the Departments, and exclusively the consideration of all appropriations... the Committee on National Banks and Currency... have in charge all the bank interests of the country. These interests are so connected by relations of exchanges and currency with bank issues and banking capital in the States that it is as much as one committee can well do to study these questions properly.2

21.7 By 1880 the committee's jurisdiction rule included subjects related to the raising of revenue and the bonded debt of the United States. During the Great Depression of the 1930s the national social security programs were added to the jurisdiction of Ways and Means since they were financed by payroll taxes.

21.8 Under the Legislative Reorganization Act of 1946 the jurisdiction of the committee included:

- a) customs, collection districts, and ports of entry and delivery; b) national social security; c) reciprocal trade agreements; d) revenue measures generally; e) revenue measures relating to the insular possessions; f) the bonded debt of the United States; g) the deposit of public moneys; and h) transportation of dutiable goods.3

21.9 Since that time its mandate has been expanded to include general revenue sharing (until 1974), proposals for national health insurance, medicare and medicaid (until 1974), foreign trade generally, and a wide variety of measures which seek to provide policy direction through the tax system.

21.10 The Committee on Ways and Means has always been one of the most important in the House, and has enjoyed certain privileges that go with its responsibility. During the early years, it reported the resolutions that distributed portions of the President's messages to the various committees, and concurrent resolutions for the adjournment of Congress. Before 1865 the committee reported such a large percentage of the important legislation that the chairman of Ways and Means was de-facto floor leader, and was later the named floor leader. For a brief period, 1865-95, the chairman of the Appropriations Committee was floor leader, but the position was returned to Ways and Means where it remained until 1919, after which time the floor leader was no longer a member of any committee. For many years the committee acted as the Democratic "committee on committees," appointing that party's membership to House committees.

21.11 Since 1860 the committee has had the right to report at any time, and since 1913 it has been classified as an "exclusive committee," which denies its members membership on any other committee. For many years the important legislation reported by Ways and Means has been granted a "closed rule" on the floor because floor amendment to the complex and detailed bills would be difficult and risky.

21.12 The records of the committee are described below in three chronological categories which correspond to its major jurisdictional and organizational changes: the 3rd-38th Congresses, from its origin as a select committee in 1793 until the jurisdictions of appropriations and banking and currency were removed from its jurisdiction in 1865; the 39th-79th Congresses, from the jurisdictional split of 1865 until the reorganization of 1947; and the 80th-90th Congresses, the post-reorganization period.

21.13 In addition to the records of the committee, the committee has retired a "historical collection" of documents which can facilitate certain types of research concerning the committee and the subjects within its purview.

Records of the Committee on Ways and Means, 3rd-38th Congresses (1795-1865)

21.14 The earliest records of the committee are two bound volumes of transcribed reports of the select and standing Committees on Ways and Means, 3d-7th Congresses (3C-A2), and 8th-18th Congresses (8C-A2), which cover the years 1793 through 1825. Both volumes contain substantially more than their titles indicate. In addition to reports on bills, resolutions, petitions, memorials, and the portions of the President's messages that were referred to the committee, the volumes also contain transcribed letters and other statements from the Treasury Department, and committee responses to these, as well as excerpts from the House Journal that show the appointment of the committee and define its jurisdiction. The volumes contain the collected documents of the committee for the period before the publication of committee reports and documents in the Congressional Serial Set. After the 16th Congress (1819-21) reports of all committees of the House are printed in the Serial Set and are available at most depository libraries.

21.15 Although there are no minute or docket books from the first six decades the committee functioned, after 1855 there are almost complete collections of both types of document. The minute books provide insights into the activities in committee meetings, including: a record of the consideration of bills and resolutions and sometimes mark-up sessions; appointment of subcommittees and referral of subjects to them; and committee discussions about proposed hearings and witnesses, and the appearance of witnesses before the committee.

21.16 The early committee docket books contain entries for documents referred to the committee, and occasionally comments concerning the subsequent disposition or action on each document. The docket books for the 35th and 36th Congresses attempt to list the documents in alphabetical order according to subject, but are difficult to research because of the indexing format—all letters are listed under the alphabetical category "L" along with other subjects such as legislation, life-saving stations, and Peter Lammond. In the 37th and later Congresses, the docket books list the documents received by the committee in chronological order, and thus provide a day by day summary of the business before the committee. The 37th Congress volume, for example lists over 400 bills, resolutions, petitions, memorials, messages from the President, and letters from executive departments between July 8, 1861 and February 19, 1863.

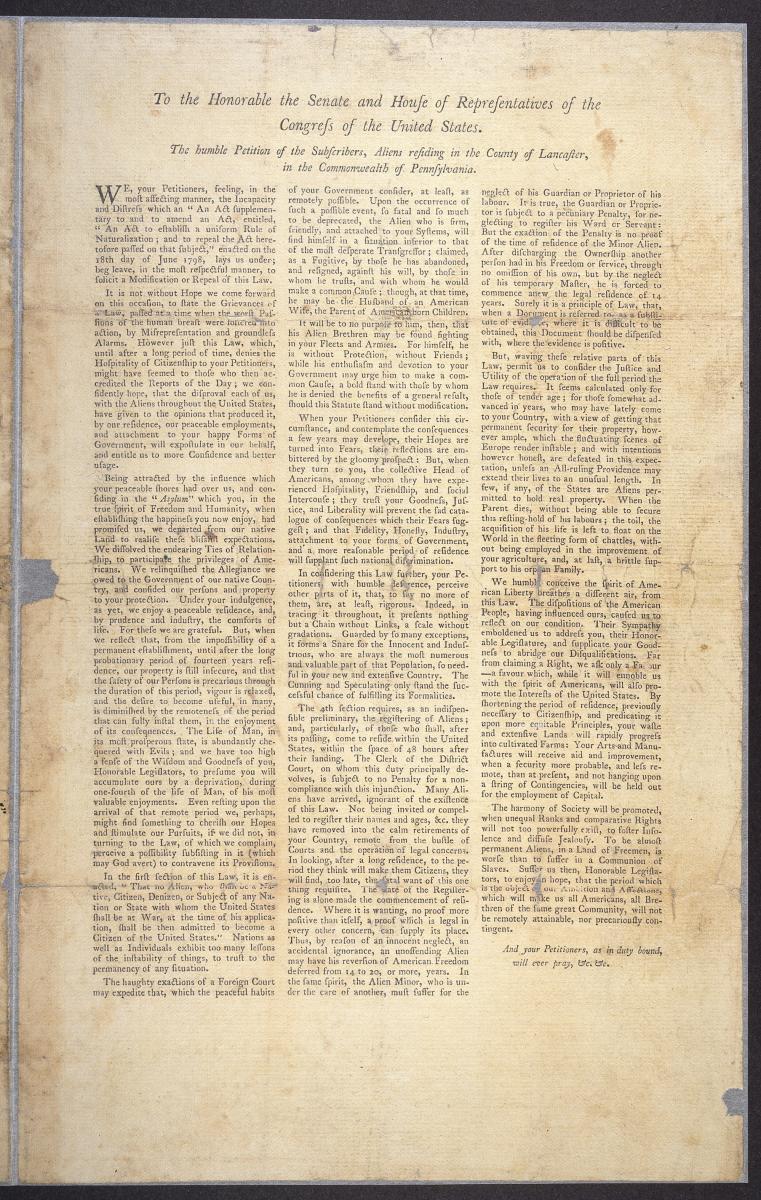

21.17 A large number of petitions and memorials were referred to the Ways and Means Committee because of its jurisdiction over revenue and appropriations. There are few petitions and memorials in the committee files for the earliest years (1799-1813), but the volume increases for the remainder of the period (1813-65). The petitions and memorials reflect the three major areas of the committee's early jurisdiction: appropriations, revenue (taxes and tariffs), and certain types of claims against the government.

21.18 Petitions and memorials concerning the tariff laws and duties on specific commodities appear in the records of almost every Congress between the 7th and the 38th (1801-65). Some of the petitions ask for the amendment, repeal, or continuance of specific tariff laws; for example, over 16 inches of petitions were received between 1843 and 1851, most of which were against revision of the Tariff Acts of 1842 and 1846 (28A-G24.8, 29A-G22.3, 30A-G24.1, 31A-G24.1). These petitions include resolutions adopted at an 1846 mass meeting in Pittsburgh, PA, in which the petitioners demand that Congress not change the Tariff of 1842, which provided adequate protection for industry at home. The protectionist sentiment is expressed clearly in the following resolution adopted at the meeting:

- That if a government cannot protect the labor of its citizens, it is too weak—if it will not, it is too indifferent—and if it dare not, it is too cowardly to deserve the support of a free and enlightened people. (29A-G22.3)

21.19 A large number of the petitions are from individuals or interest groups seeking to effect changes in the duties upon specific commodities such as wool or tobacco products. The records from the 28th Congress (1843-45) include petitions on the duties on guano (28A-G24.2), objects of art (28A-G24.3), railroad iron (28A-G24.4), and salt (28A-G24.5), as well as petitions relating to the Tariff of 1842 (28A-G24.8). The 33d Congress (1853-55) records include petitions involving the tariffs on iron, coal, glass and cotton (32A-G24.10), salt, ivory, and raw silk (32A-G24.11), and a file on customhouses (32A-G24.7).

21.20 Petitions relating to various excise and direct taxes also appear in the records of nearly every Congress prior to the Civil War. A tax imposed on distilleries and distilled spirits is the subject of numerous petitions asking for repeal of the law or seeking reimbursement for damages caused by its enforcement (7A-F3.1, 13A-G12.6, 14A-F15.6, 38A-G24.14). The petition of one distiller, Levi Bellows, asking for payment for damages done by United States tax collectors, contains a large number of documents recording his dealings with the tax collectors and the Vermont district courts in the case (16A-G20.2).

21.21 Other petitions protest against a tax on the auction system (21A-G21.1), a tax on coal (24A-G21.2), the enactment of a tax on dogs (38A-G24.4), a national income tax (38A-G24.11), a capitation tax on immigrants (32A-G24.3), a tax on the gross receipts of ships and vessels (38A-G24.13), and excise taxes on domestic manufactures (14A-F15.2).

21.22 Petitions submitting private claims appear in the records of every Congress between 1809 and 1864. The claims referred to Ways and Means covered a wide range of problems. The claims petitions from the 34th Congress (1855-57) include a prayer to be released from a contract to carry the mail; a claim for indemnification to a stockholder for losses by the Bank of the United States; a claim for refund of certain duties wrongly paid by the petitioner; a request for an appropriation to pay arrears in pensions; and, ten petitions from government employees (lighthouse keepers, customs collectors, clerks at assay offices, and clerks and watchmen at executive departments) asking increased compensation due to extraordinary circumstances (34A-G22.1).

21.23 The claims petitions referred to the committee during the 12th Congress (1811-13) provide more examples of the claims referred to the committee. They include petitions from George Lyon, an assistant clerk at the patent office, asking that a special appropriation be made to pay his salary; from Doyle Sweeney, asking for compensation for working as a clerk in the surveyor's office; from Commodore Joshua Barney, asking for himself and owners and crew of private armed vessels, to be better rewarded for their seizures of enemy property under the "Act of Non-Importation"; from several persons who thought their property had been wrongly seized by customs or revenue officers; and from Stephen Kingston, who made an appeal for enemy property seized from a vessel he helped identify (12A-F10.4).

21.24 Petitions for increases or reductions in the pay of Government employees appear in the records of many Congresses (8A-F4.2, 9A-F6.1, 10A-F8.1, 12A-F10.1, 14A-F15.3, 16A-G20.1, 21A-G21.3, 32A-G24.9). Many of the early appeals to increase government salaries were made by government employees, especially collectors of revenue. They are not classified as "claims" because they pray for pay raises rather than for special compensation due to extraordinary services rendered, or extraordinary costs incurred in the line of duty.

21.25 The subject of currency, coinage and mints appears under various headings in the petition files for each Congress between 1851 and 1865: Branch mints (32A-G24.2); opposition to the removal of a U.S. Mint from Philadelphia (33A-G25.7); mint and assay offices (35A-G25.3); copper coins (36A-G22.1); the establishment of a branch mint in New York City (37A-G20.5); national currency (37A-G20.2); and the location of a branch mint in Portland, OR (38A-G24.9). The petitions provide evidence of public opinion, and in some cases may contain unique sources of historical data. For instance, a 31st Congress (1849-51) memorial from Professor R.S. McCulloh of the College of New Jersey in Princeton, requested "an investigation and legislation in relation to a new method of refining gold" (31A-G24.3). The voluminous memorial submitted by Professor McCulloh, formerly a melter and refiner of the United States Mint, consists of a 25-page printed memorial and 70 attached exhibits. It presents McCulloh's view of some of the problems of refining, and may contain valuable information about American refining at mid-century.

21.26 A wide range of transient subjects appear in the petition files of several Congresses, such as: the embargo between 1811 and 1815 (12A-F10.3, 13A-G12.4); the charter of the Bank of the United States between 1831 and 1839 (22A-G24.1, 23A-G20.2); the debts of the Republic of Texas between 1851 and 1855 (32A-G24.5, 33A-G25.3); and the colonization of free Negroes in Liberia at mid-century (32A-G24.6). There are petitions concerning internal improvements during the decade of the 1840s: improvement of rivers and harbors (26A-G25.2); breakwaters, lighthouses, and piers (27A-G25.1); and the improvement of the Hudson River (28A-G24.6). The records from 1813-15 contain petitions from persons who had been imprisoned for debt (13A-G12.5).

21.27 The committee papers consist primarily of communications from executive agencies concerning appropriations; correspondence and documents from individuals relating to claims; correspondence relating to revenue policy; and copies of bills, resolutions, and committee reports. The records are arranged by subject, and a listing of subject categories for each Congress is contained in the Preliminary Inventory to Records of the House of Representatives, 1798-1946.

21.28 Records relating to appropriations to finance the government constitute the largest portion of the committee papers before the Civil War. After the war similar records related to appropriations are located in the committee papers of the Appropriations Committee. Appropriations records in the early committee papers (1799-1825) are not voluminous and are usually filed under a single heading as in the 12th Congress, "papers relative to the appropriations for the support of the Government in 1813" (12A-C10.1, 1 in.), or the 15th Congress file, "papers relating to estimates and appropriations" (15A-D15.1, 3 in.).

21.29 After the 18th Congress, records relating to appropriations are more voluminous and the descriptive categories used are more differentiated. The records are filed by the Department, Bureau or activity to which they relate—the records of the 35th Congress (1857-59), for example, contain appropriations records relating to the census; the consular and diplomatic service; the courts in the District of Columbia; the Houses of Congress; the Interior Department including the land office system; Indians; pensions; lighthouses; Navy shop equipment; the Northwestern Boundary Survey; the postal service; printing and binding; public buildings and property; the Smithsonian Institution; the territories; and the White House (selected files 35A-D22.1 through 35A-D22.22).

21.30 The files generally contain documents from or about the executive Departments, including estimates of appropriations, letters requesting and justifying appropriations, progress reports, documents relating to Government contracts, and documents concerning the quality of workmanship and the economical use of appropriated money. A typical estimate of appropriations file from an Agency contains copies of reports from the Agency along with charts, schedules, letters, correspondence, and other documents supporting the reports.

21.31 Some documents provide insight into the operations of the executive branch in general; for instance, the committee papers from the 10th Congress (10A-C6.1) contain a chart showing salaries of Government employees in 1808, and the 27th Congress records contain a file on "clerks and officers in the Government" that includes correspondence from the executive departments and bureaus describing the duties and pay of their employees about 1841 (27A-D24.3).

21.32 While records relating to appropriations make up the largest portion of the committee papers for most Congresses, the subjects of tariff or tax policy, collection of duties, and related revenue subjects also appear frequently. Revenue subjects appear under a variety of headings in the committee papers files: Duties (14A-C16.1), direct tax in Delaware and Georgia (14A-C16.3), comparative schedules of tariffs, imports, and exports for 1815-1819 (16A-D25.1), revenue and finance (17A-C26.3), duties on woolens (19A-D22.1), reduction of duties on imports (22A-D25.4, 34A-D23.1), collection of duties on imports (26A-D29.7, 30A-D25.1), tariff and tariff policy (29A-D22.11), income tax (37A-E20.14), tariff (37A-E20.17, 38A-E22.18), taxation policy (38A-E22.19), and commodity tariff and other taxation (38A-E22.4).

21.33 Records relating to foreign trade and tariff policy during the 19th century are sometimes located in the records of the Committee on Commerce and Manufactures (1795-1819), the Committee on Commerce (1819-91), and the Committee on Manufactures (1819-1911) . There are petitions and memorials and other records involving duties, drawbacks, the protection of American industry, and related subjects in the records of these committees in every Congress between 1799 and 1835.

21.34 The committee papers contain records relating to the Bank of the United States (21A-D24.1, 22A-D25.1, 23A-D22.2, 25A-D23.1); coinage and finance (35A-D22.3); currency, a national bank, and an independent treasury (25A-D26.5); foreign money (29A-D22.2); and a plan for an exchequer (27A-D24.2). Jurisdiction over these subjects was transferred to the Banking and Currency Committee after 1865.

21.35 There are claims records for almost every Congress before the Civil War. The claims records in the committee papers files are usually related to the claims petitions in the petition and memorial files. Generally, a claim petition and supporting documents submitted with it are filed in the petition and memorial files, and the material subsequently collected or generated by the committee are in the committee papers file—this usually consists of a manuscript copy of a committee report on a claim petition, and occasionally a report on a claim from an executive agency.

Records of the Committee on Ways and Means, 39th-79th Congresses (1865-1946)

21.36 The minute books are generally thorough. They record the attendance and agenda of meetings of the committee, including appointment of standing subcommittees and referral of documents to them, appointment of committee clerks, committee discussions of legislation, mark-up sessions, and preparation of committee reports.

21.37 Some minute books include roll call votes, and some include brief entries listing activities in executive sessions (60th Congress minutes). The minutes may also contain detailed records of markup sessions such as those on December 11 and 12, 1893 during which the committee marked up the Wilson-Gorman tariff bill (53A-F46.5, 17 pages).

21.38 The minutes document numerous decisions that affected the operations of the committee; for instance, the minutes of the 46th Congress note that on April 29, 1879, James Garfield was appointed chairman of a subcommittee to inquire into the subject of what books the committee would require for its new technical library.

21.39 The docket books of the Ways and Means Committee provide an important source of documentation for a variety of types of research. They provide a continuous record of the documents referred to the committee and, in some cases, "chairman's remarks" regarding their disposition. Committee calendars continue this type of documentation after the docket book series stops. The committee "Historical Series" contains committee calendars from the 60th through the 75th Congresses (1907-38); later calendars are filed among the committee papers.

21.40 There is at least one docket book for each Congress between 1865 and 1901, and in many cases there are several docket books for different types of dockets, such as a docket book for House and Senate Bills and Resolutions, and one or more docket books for petitions. The active committee of the 53d Congress (1893-95) left four volumes of dockets—three petition docket books that list over 2,600 petitions in chronological order of receipt, and a mailing docket that contains an alphabetical list of persons who received copies of committee publications. The 2,600 entries listed in the petition dockets amount to 9 linear feet in the petition and memorial files; they include a large number of documents on Wilson Tariff bill (53A-H33.11, 45 in.) and smaller numbers on specific sections of the tariff bill, such as coal and iron ore (53A-H33.6, 8 in.), books (53A-H33.3, 1 in.), alcohol, beer, whiskey, and other distilled spirits (53A-H33.1, 1 in.), barley and flax (53A-H33.2, 2 in.), and cigars and tobacco (53A-H33.5, 29 in.). The 53d Congress records also contain petitions on the income tax (53A-H33.10, 4 in.).

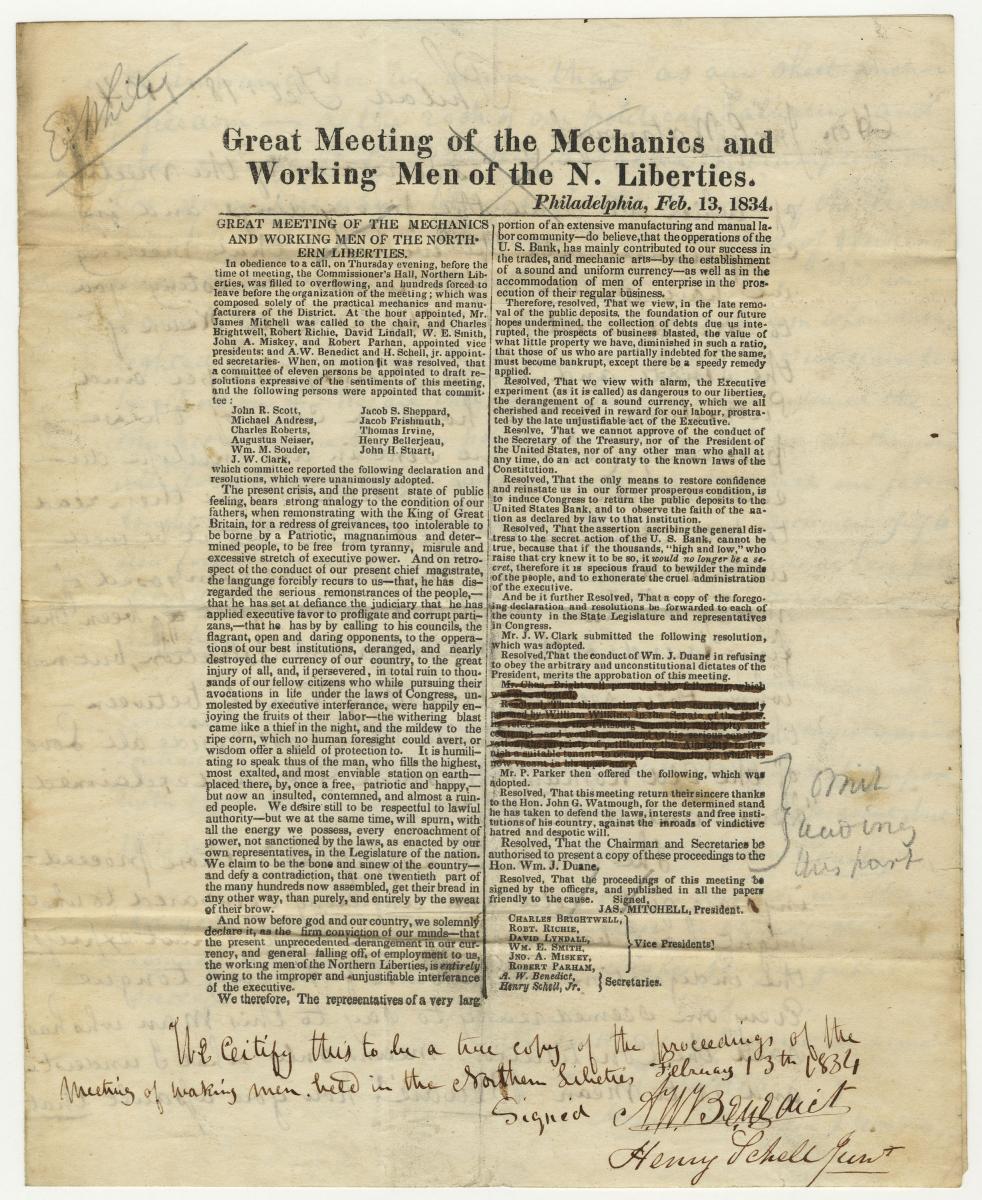

21.41 Although the jurisdiction of the committee was truncated after the 38th Congress (appropriations and banking legislation having been removed), there is a marked increase in the size of the petition and memorial files after 1865. Petitions and memorials for this period average 4 feet per Congress, the main subjects being the government revenue policies regarding taxes and tariffs, the bonded debt of the United States, foreign trade, and embargoes and commercial treaty matters. Other subjects of concern during this period include the payment of special bonuses to military officers and enlisted men, and proposals for unemployment insurance and other forms of social insurance. The petitions and memorials are arranged by subject when a sufficient quantity of petitions on a subject were received, or in a catch-all "various subjects" category for miscellaneous small subjects.

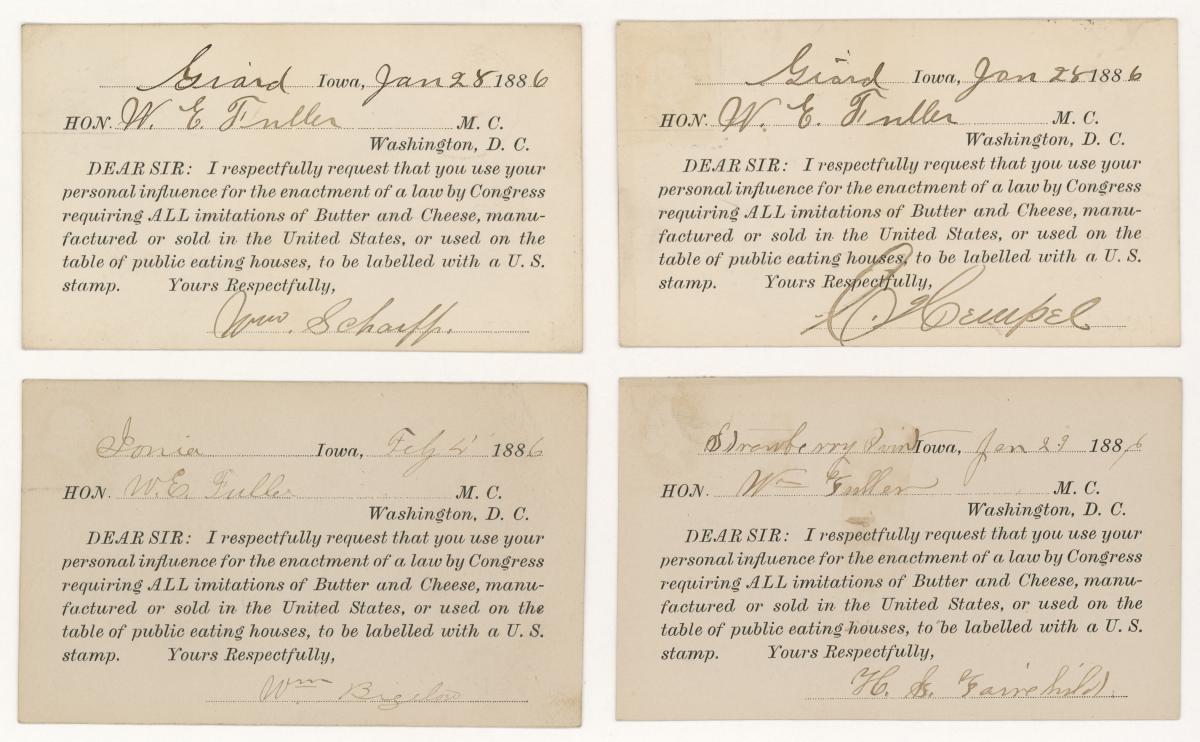

21.42 During the first half of this period the bulk of the petitions referred to the committee pertain to taxation and the tariff. Tariff petitions drop off markedly after the 64th Congress when the U.S. Tariff Commission was created (1916). As in the earlier files, petitions and memorials relating to tariffs on specific commodities appear consistently in the records of every Congress and are arranged by commodity or commodity groups. The grouping of like commodities makes possible a certain level of description, but it also makes the searches for particular subjects more complex than simple alphabetical subject searches. For example, the files for the 46th Congress (1879-81) cover the following subject groups: cattle, sheep, and horses (46A-H24.4); chrome, iron ore, and bichromate of potash (46A-H24.5); cigarettes, cigars, and tobacco (46A-H24.6); medicine, perfumes, and cosmetics (46A-H24.19); and wine, distilled and fermented liquors, and beer (46A-H24.34). The commodity subject groups are arranged alphabetically by the first commodity to appear in the group.

21.43 One of the largest petitions was received by the committee during the 52d Congress (1891-93) from tailors opposed to the free entry of wearing apparel and other personal effects belonging to immigrants arriving in the country (52A-H24.16, 5 ft.). The petition forms, which were printed in the May 1892 issue of The Sartorial Arts Journal, express the displeasure of merchant tailors with the construction of section 2 of the Free List of the Tariff Act of October 1, 1890.

21.44 In addition to those petitions and memorials suggesting alterations in the tax or tariff on specific commodities, there are others favoring more general changes in the revenue laws. Examples include petitions for the creation of a Tariff Commission (46A-H24.3, 47A-H22.17, 60A-H36.1, 61A-H34.2), petitions on the general reduction of tariffs (44A-H20.31, 45A-H25.31, 47A-H22.9, 49A-H25.15, 51A-H23.9, 52A-H24.11), and petitions on income tax and other tax laws (40A-H19.11, 41A-H15.7, 45A-H25.1, 53A-H33.10, 63A-H30.2, and every Congress between 1919 and 1933).

21.45 The petitions on taxes fall into various categories: a national income tax (38A-G24.11, 40A-H27.19, 46A-H24.14, 53A-H33.10, 63A-H30.2, 71A-H18.6), a tax on corporations (61A-H34.21, 62A-H31.1), tax reduction (40A-H19.14), tax law repeal (42A-H15.10), and others. There are also petitions on taxes on specific commodities and activities such as fire insurance company premiums (39A-H25.19), medicinal preparations (42A-H15.11), bologna sausage (44A-H20.3), and legacy and succession taxes (41A-H15.11). A tax on bank deposits and checks generated over 4 feet of petitions between 1875 and 1883 (44A-H29.2, 45A-H25.37, 46A-24.30, 47A-H22.26).

21.46 Other subjects which appear in the petition and memorial files include the funding of the national debt (41A-H15.6, 46A-H24.22, 48A-H30.8); repeal of the Specie Resumption Act (45A-H25.29); banking and currency (39A-H25.2, 43A-H19.1, 45A-H25.12); trusts, combines, and monopolies (51A-H23.13); adulteration of pure food (55A-H29.2); a commission to study the alcoholic liquor traffic (44A-H20.1, 45A-H25.1); a commission to study prohibition (63A-H30.4); Government wages and hours (46A-H24.33, 70A-H15.3, 72A-H16.17); and a plan for a subtreasury (51A-H23.11).

21.47 The apparent importance of a subject did not necessarily determine the volume of petitions it would generate. For example, during the 64th Congress (1915-17) there were petitions: asking Congress to prohibit the sale of arms and ammunition to the belligerents in Europe (64A-H26.15); praying for passage of legislation to levy a tax on corporate profits in excess of 8 percent (64A-H26.17) and for passage of H.J. Res. 127, a resolution to call upon the Allied Powers to allow Germany and Austria to import milk for the relief of babies (64A-H26.7); proposing an embargo on the exportation of foodstuffs (64A-H26.7); protesting the taxes imposed under the Emergency Revenue Act (64A-H26.8), and numerous other subjects. The largest number of petitions were concerned with a tax on mail-order houses (46A-H26.14, 2 ft.).

21.48 Just after the end of World War I the subjects in the petition and memorial files begin to change. Large numbers of petitions and memorials concerning various forms of adjusted compensation and loans for veterans, and bonuses for officers and enlisted men are among the records of every Congress between 1919 and 1936 (66A-H21.1, 67A-H23.4, 68A-H21.1, 69A-H18.1, 70A-H15.5, 71A-H18.2, 72A-H16.1, 73A-H21.1, 74A-H20.1). During this period, veterans also petitioned for better hospital facilities (66A-H21.2).

21.49 Beginning about 1933 the records from every Congress contain petitions and memorials requesting some form of national social security legislation. The files for the 74th Congress (1935-36) contain over 11 feet of petitions and memorials demanding some type of old age and unemployment insurance (74A-H20.12), or favoring the Townsend plan (74A-H20.11) or the Will Rogers pension plan (74A-H20.11). In addition to records in the petition and memorial files, the committee records for the years following 1933 contain voluminous committee papers files and bill files on the subject of social insurance (see paragraphs 21.59-60.).

21.50 Committee papers average 2 feet per Congress before the 60th Congress (1907), and 11 feet per Congress from the 61st through 79th Congresses. The records are arranged by subject and reflect the important changes in the issues that affected the committee during the 82 year period between the Civil War and World War II.

21.51 During this period the committee papers from almost every Congress contain files on tariff policy, tax policy, and the tariffs and taxes on various commodities. These files make up a large proportion of the total committee papers files throughout most of the period. For example, about half of the committee papers from the 61st through 71st Congresses (1909-31) relate to taxes or tariffs. The records include correspondence on: The Revenue Acts of 1924 (68A-F39.1), 1926 (69A-F41.7), 1928 (70A-F32.3), 1937 (75A-F38.1), and 1943 (78A-F38.19); tariff "free-list" correspondence (61A-F48.2, 62A-F37.2, 63A-F39.3); the Emergency Tariff Act of 1921 (67A-F39.4 and F39.5), and the Tariff Act of 1922 (67A-F39.8 and F39.9); and various other tariff acts (61A-F48.1, 62A-F37.1, 63A-F39.2, 66A-F38.2, 70A-F32.4, 71A-F36.5). The correspondence that is concerned with the tariff or tax on a particular commodity is usually arranged alphabetically by the name of the commodity or by the schedule that applies to it.

21.52 Other tax-related records include Internal Revenue Service lists of adjustments paid for taxes illegally or erroneously collected between 1924 and 1927 (67A-F39.7, 68A-F39.1, 69A-F41.6, 11 ft.).

21.53 Committee papers also contain records of investigations conducted by the committee on subjects such as whiskey revenue frauds (40A-F27.12) and other revenue frauds (40A-F27.13); the transfer of gold and other transactions of the subtreasury at San Francisco with the Bank of California (41A-F27.14); a subsidy to the Pacific Mail Steamship Company (42A-F30.9, 43A-F30.4); and the New York Customhouse (45A-F36.5).

21.54 The records include files on subjects related to commercial treaty relations of the United States with other nations, such as reciprocity treaties and reciprocal trade agreements (39A-F27.8, 40A-F27.4, 54A-F43.9, 79A-F37.2); violation of the United States-Russian treaty of 1833 with respect to hemp (41A-F27.2); trade with Brazil (42A-F30.12); a duty on fish caught in Canadian waters (46A-F36.2); a treaty of commerce with Mexico (48A-F36.11); commercial treaties and trade information (51A-F41.2); and the Mexican "Free Zone" (53A-F46.3).

21.55 Records relating to claims form a less significant part of the records of the committee, but there are separate claims files for the 47th, 48th and 51st Congresses (47A-F30.2, 48A-F36.3, 51A-F41.1). Additional claims records may be found in the "various subjects" headings, or in various locations in the alphabetical subject files.

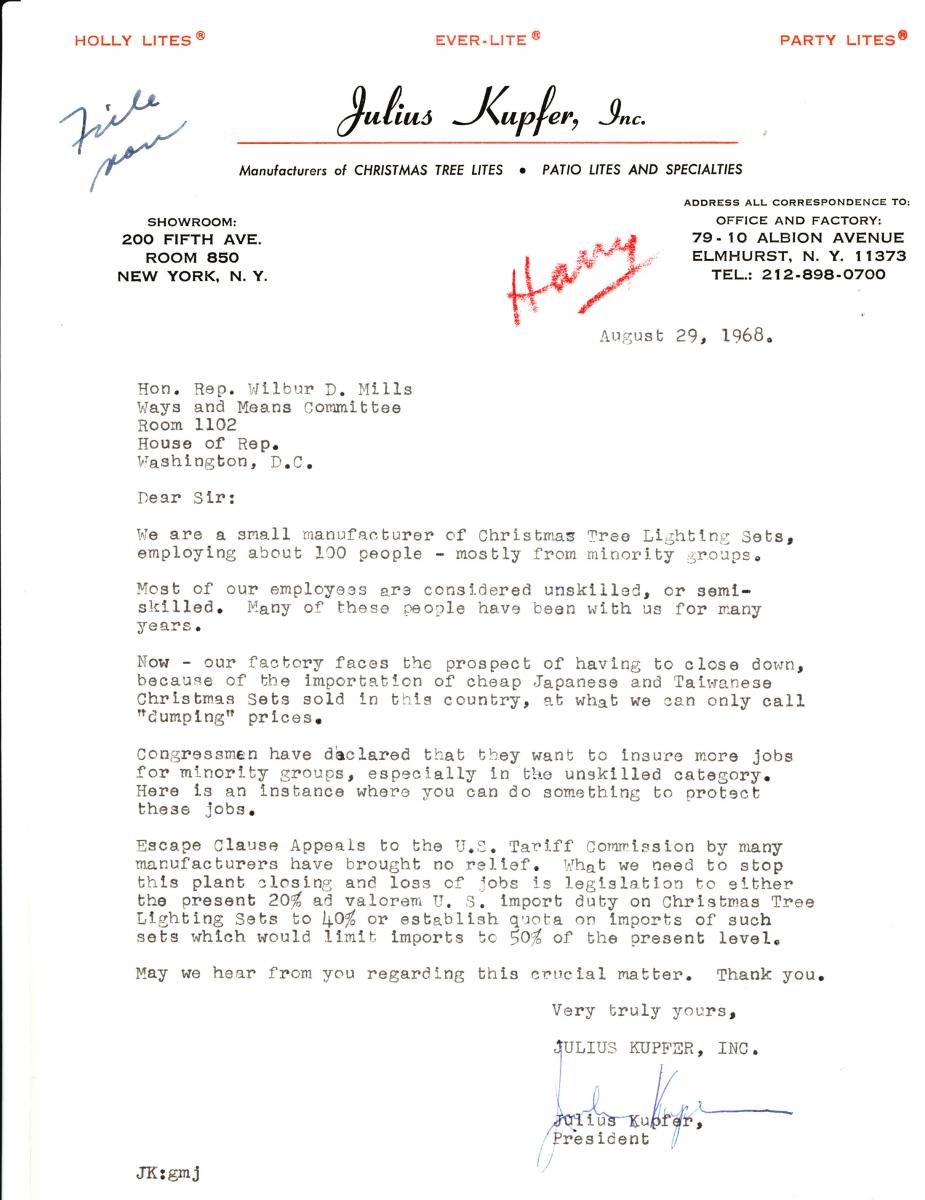

21.56 Other subjects that appear in the committee papers include the World's Columbian Exposition (53A-F46.2); the condition of national finances (54A-F43.5, 59A-F36.2); adulteration of food and drink such as cheese and butter (47A-F30.1) and beer (54A-F43.2); drawbacks on exports (many Congresses); banking and currency, including greenback inflation and resumption of specie payment (40A-F27.32); the Customs Service (67A-F39.3); alien property (69A-F41.4); birth control (72A-F29.2); Federal aid to States (75A-F38.2); and the National Firearms Registration Act (75A-F38.4, 4 feet).

21.57 The committee papers files after the 60th Congress (1907-09) contain large correspondence files expressing the opinions of lawyers, businessmen, and a wide variety of other citizens on public policy issues. During this period correspondence in the committee papers files replace the petitions and memorials as the primary source of documentation of public opinion. The records relating to the proposed veteran's bonus provide an example of the dispersal of subject-related records in the committee files.

21.58 The subject of bonuses or "adjusted compensation" for veterans appears in both petition and memorial and committee papers files of most Congresses between the 66th and 74th (1919-36). The records of the 66th Congress (1919-21) contain over 3 feet of correspondence in the committee papers file (66A-F38.2), and 1 foot of petitions and memorials (66A-H21.1) on the subject. The 67th Congress records contain 2 feet of correspondence on the veteran's bonus in the committee papers (67A-F39.1), as well as petitions and memorials (67A-H23.1), and a bill file (67A-D36) for H.R. 10874, the veteran's bonus bill, which contains President Warren G. Harding's original veto message.

21.59 The dispersal of communications from citizens concerned about the need for national social insurance provides another example of the distribution of subject related documents throughout the committee's files. After the 73d Congress, records relating to some type of social insurance appear in the bill files, petitions and memorials, and committee papers of every Congress until at least the 83d (1954). The Ways and Means Committee records relating to this subject in the 73d Congress (1933-34) are slight, consisting of a bill file on the Wagner-Lewis unemployment insurance bill (73A-D33), and a few petitions on unemployment insurance (73A-H21.20). During the 74th Congress (1935-36) the committee was flooded with over 11 feet of communications on the subject: there are petitions on the Townsend plan (74A-H20.11), unemployment and old-age insurance (74A-H20.12), and the Will Rogers' pension plan (74A-H20.13); there are bill files on H.R. 7260, the Social Security Act (74A-D38) and H.R. 4120, the Economic Security Act (74A-D38); and there is correspondence filed alphabetically under "Social Security" (74A-F39.1) in the committee papers correspondence file. After 1933 the committee records for every Congress contain correspondence and/or petitions relating to the subject.

21.60 The 75th Congress file contains over 5 feet of material in a bill file on H.R. 4199, the Townsend recovery act or general welfare act of 1937, as well as petitions on the subject. The 76th Congress committee papers file contains over 7 feet of correspondence on the Townsend plan, 6 feet on the Social Security Act, 6 feet of consolidated printed hearings on social security along with index cards to the hearings, and almost 5 feet of petitions and memorials on social security, welfare and relief.

21.61 The committee papers files also contain several types of administrative records. The records from 1865 through 1871 contain lists that may have been used in the appointment of House Members to membership on various House Committees (39A-F27.1, 40A-F27.2, 41A-F27.4). The records of numerous Congresses contain mailing lists and "request correspondence" files that provide evidence of the numbers and types of persons who requested and received prints of the committee hearings, reports, and bills, and who may have testified on the important finance issues. These records may be buried in alphabetical subject files (sometimes filed under "R" for "request correspondence"), but they are sometimes broken out as separate categories. Some of the "request correspondence" files between 1909 and 1941 (61A-F48.5, 68A-F39.1, 69A-F41.8, 71A-F36.3, 72A-F29.14, and 76A-F41.1) are voluminous, averaging over 1 foot per Congress.

21.62 There are bill files for every Congress between the 58th and 79th. The files generally contain the same types of records that are found in the committee papers files, except that they are arranged by bill or resolution number, instead of by subject. In most cases, the bill files should be used in conjunction with the correspondence files in the committee papers because some documents may be filed by subject while others are filed by bill. The bill files average less than 2 feet per Congress with the exception of the 75th Congress file which contains 6 feet of correspondence on HR 3134, a tax on fuel oil, and 6 feet of correspondence on HR 4199, the 1937 Townsend recovery act.

Records of the Committee on Ways and Means, 80th-90th Congresses (1947-1968)

21.63 There are no docket books after 1947, but the committee calendars document much of the information that had been included in the docket books previously.

21.64 The minute books of the Ways and Means Committee for the 80th to 90th Congresses are the most voluminous, and probably the most complete of any committee in Congress. Beginning in the 81st Congress (1949-50) the minutes are so extensive that they require multiple volumes. The minute books include the actual minutes typed on loose leaf pages and bound together with a wide variety of related documents such as transcripts of executive session hearings, confidential committee prints, printed bills and resolutions, and briefs and summaries of legislation prepared for committee meetings. Some of the minute volumes are indexed.

21.65 The typed minutes proper (not counting the exhibits and other attached documents) appear to be very thorough, including summaries of the comments of all speakers at meetings. Minutes of some executive session meetings appear to be especially well documented; for instance the executive session meeting of November 29, 1950 includes 23 pages of discussion summary and roll call vote tallies.

21.66 There are two volumes of subcommittee minutes. One volume contains minutes from the Subcommittee on Internal Revenue Taxation, 85th Congress. The second volume contains the minutes from the Subcommittees on Excise Taxes, 85th Congress; Foreign Trade Policy, 85th Congress; Administration of the Social Security Laws, 86th Congress; Administration of the Internal Revenue Laws, 81st-83d Congresses; and Customs, Tariffs, and Reciprocal Trade Agreements, 85th Congress.

21.67 The petition and memorial files for the 80th-89th Congresses are generally smaller than those from the period between the Civil War and World War II because correspondence replaced petitions and memorials as the primary method for citizens to express their concerns to Congress. The subjects of the petitions and memorials included excise taxes, income taxes, taxes on State and municipal bond interest, tariffs, social security, pension plans for the self-employed, medical care for the aged, and trade agreements. Petitions favoring the Townsend plans appear in the records until the 83d Congress (1954). The more recent files contain resolutions from State and Territorial governments and small numbers of petitions and memorials from private citizens.

21.68 The committee papers consist primarily of correspondence arranged by subject. In addition to correspondence, there are usually executive communications, messages from the President, transcripts of hearings, printed copies of bills and resolutions, hearings and reports, and a variety of other types of documents.

21.69 Correspondence files comprise the bulk of the committee papers may be arranged by subject in alphabetical order or in large files on a given subject may be filed individually—not as part of a larger alpha-file. The subject files generally consist of correspondence from private citizens, from interested trade or professional organizations or businesses, and from other government agencies. They occasionally contain documents relating to hearings, materials submitted or procured by the committee for research purposes, memos and other documents produced by staff members, and other documents relating to the subject. An 80th Congress (1947-48) file on tax exempt cooperatives (80A-F18.6) consists of 8 feet of correspondence and 1 foot of statements, briefs, summaries, and other documents submitted at hearings on the subject. In several Congresses the subject files are supplemented by chronological files of outgoing correspondence called "green files" (86A-F17).

21.70 There are correspondence files on social security in the records of each Congress between the 80th and 90th. Other subjects that appear are income tax, tax reduction, tax exemption, and tax revision; pensions, annuities, and medical care for the aged; excess profits, capital gains and double taxation of bonds; the tariffs; reciprocal trade agreements; renegotiation of war contracts; a national lottery; postal rates; revenue sharing; the Revenue Act of 1964; unemployment compensation; veteran's legislation; and natural resources taxation.

21.71 The committee papers contain records of numerous subcommittees, but the records of the subcommittees are usually spotty and incomplete. Subcommittee records are most numerous for the 82d and 83d Congresses (1951-54). The 82d Congress (1951-52) records contain correspondence and reports from the Subcommittee on Amortization; news releases and summaries of hearings from the Subcommittee on Unemployment Insurance; news releases, transcripts of executive sessions, press releases, bills, and studies from the Subcommittee on Coordination of Federal, State, and Local Taxes; and reports from various agencies from the Subcommittee on Narcotics. The 83d Congress (1953-54) records contain correspondence, hearings and reports from the Subcommittee on Taxation of Life Insurance Companies, and a substantial file from the Subcommittee on Social Security, which includes correspondence, clippings from newspapers and periodicals, press releases, speech material, hearings and other material analyzing the social security system, and various staff working papers.

21.72 The most complete subcommittee records are from the Subcommittee on the Administration of the Internal Revenue Laws, which was established in 1950 and issued its final report in 1953. There are 4 feet of transcripts, exhibits, and page proofs of hearings in the 82d Congress records, and 2 feet of correspondence and hearings in the 83d Congress records. A large collection (59 feet) of records retired separately contains the general files of the subcommittee. The records are arranged like a large subject file covering administrative, investigative, and legislative subjects. There is a folder title list that is indispensable for locating subjects in the large file.

21.73 There are bill files from every Congress between the 80th and 90th, although the files for the 80th through 82d Congresses are fragmentary. The 83d Congress file contains over 4 feet of bill files, which consist of copies of the bills and reports, copies of speeches made by representatives, correspondence from executive agencies, and correspondence from lobbyists. Some of the bill files contain transcripts of executive session meetings.

21.74 The bill files from the 84th through the 88th Congress are arranged in two series: a series of "bills not reported" and a series of "bills reported" by the committee. The files from the 80th-82d Congresses (1947-52) are sparse and incomplete, together totaling less than 1 foot of material, while the files of later years contain as much as 25 ft. per Congress. The files on certain pieces of legislation are voluminous; for instance, the file on H.R. 6675, 89th Congress, a bill to provide for old age hospital insurance under the Social Security Act, measures over 5 feet, and includes several oversize briefing books. The bill files from the 88th Congress contain a 3 foot file on H.R. 11865, the Social Security Act Amendments of 1964, and over 7 feet of documentation on H.R. 8363, the Revenue Act of 1964.

21.75 The records of the Ways and Means Committee include two special collections of material that provide easy access to vital information about its work. A collection of bound documents (84 feet) consisting of bills, resolutions, and communications from the executive department covers the period between 1881 and 1980.

21.76 The historical collection contains a variety of printed material, mostly congressional publications, and research notes of staff members prepared as part of historical studies of the committee. Included are collections of reports of the committee and acts of the committee from the 50th through the 82d Congress (1887-1952), compilations of tariff acts from 1789 to 1909, and copies of various documents printed by Congress concerning tariff acts from the 40th through the 81st Congress. There is a collection of the calendars of the Ways and Means Committee for the 60th through 75th Congresses, and the Senate Finance Committee for the 66th through 81st Congresses, and a set of indexes to reports of the Senate Finance Committee from the 31st through 54th Congresses. Other documents include lists of committee membership from the 1st through 79th Congresses, a list of committee reports for the 14th through 59th Congresses, a collection of documents from around 1933 concerning reciprocal trade agreements, and voluminous notes on various aspects of the committee's business.

Committee on Ways and Means, 91st-99th Congresses (1969-1986)

21.77 The recent records preserved by the Ways and Means Committee are not among the most voluminous of House committee records, but they are probably the most carefully prepared records of any House committee. The records of this committee average 60 feet per Congress, however, the files of the 97th Congress are swollen by a massive form petition drive which is preserved under the title "tax petition number 146" (142 ft.).

21.78 The extensive and thoroughly documented minutes of committee meetings continue to be maintained through the 100th Congress, as is the bound series of copies of all legislation introduced, Presidential Messages, executive communications, and reports from other departments and agencies. The bound volumes of documents average over 8 feet per Congress, and the minutes, which are also bound, average 5 feet per Congress. The other records preserved by the committee support the preceding series. For most Congresses there are bill files, petitions and memorials; "green correspondence" or reading files (outgoing letters arranged by month, and thereunder alphabetically by name of addressee); and occasionally records of subcommittees. The records of the 95th Congress contain records of the Subcommittee on Public Assistance and Unemployment Compensation (PAUC). Among the records of the PAUC Subcommittee are the minutes, transcripts, and roll call votes of the Welfare Reform Subcommittee, which was constituted of members of the House Agriculture, Education and Labor, and Ways and Means Committees.

21.79 The Ways and Means Committee Historical File was retired with the records of the 92nd Congress.

Notes

1 Annals of Congress, 7th Cong., 1st sess., Jan. 7, 1802, p. 412.

2 Congressional Globe, 39th Cong., 1st sess., Mar. 2, 1865, p. 1312.

3 U.S. Congress, House, Constitution, Jefferson's Manual, and Rules of the House of Representatives of the United States, Ninetieth Congress, H. Doc. 529, 89th Cong., 2d sess., 1967, p. 356.

Bibliographic note: Web version based on Guide to the Records of the United States House of Representatives at the National Archives, 1789-1989: Bicentennial Edition (Doct. No. 100-245). By Charles E. Schamel, Mary Rephlo, Rodney Ross, David Kepley, Robert W. Coren, and James Gregory Bradsher. Washington, DC: National Archives and Records Administration, 1989.

This Web version is updated from time to time to include records processed since 1989.

Return to the Table of Contents for the Guide to the Records of the U.S. House of Representatives